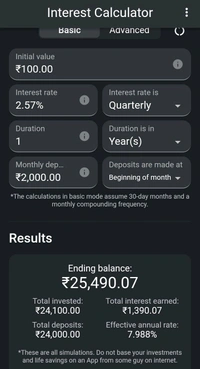

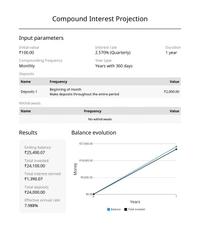

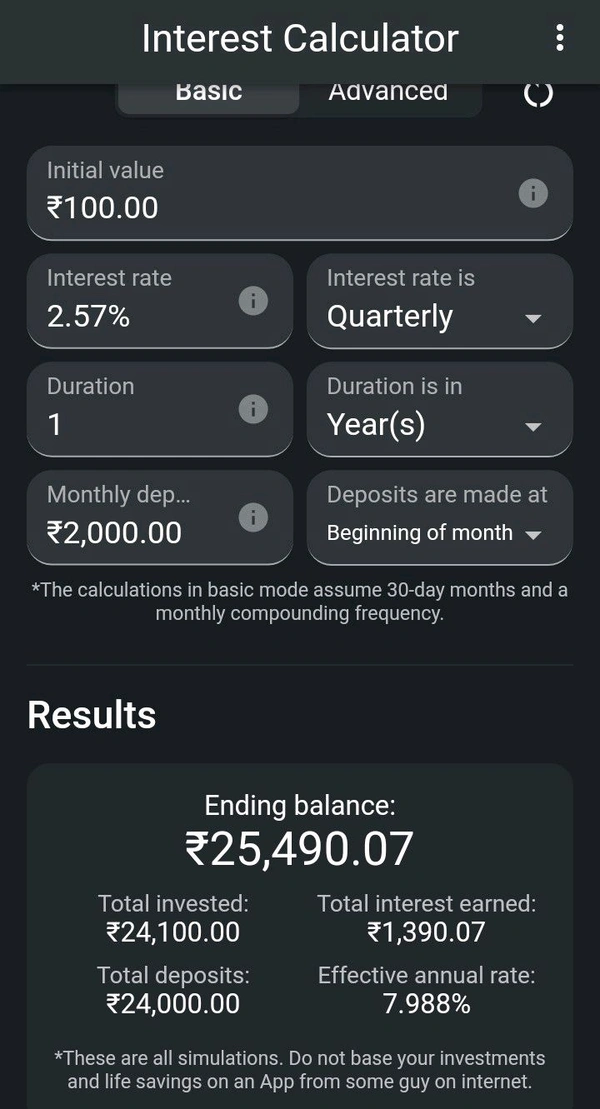

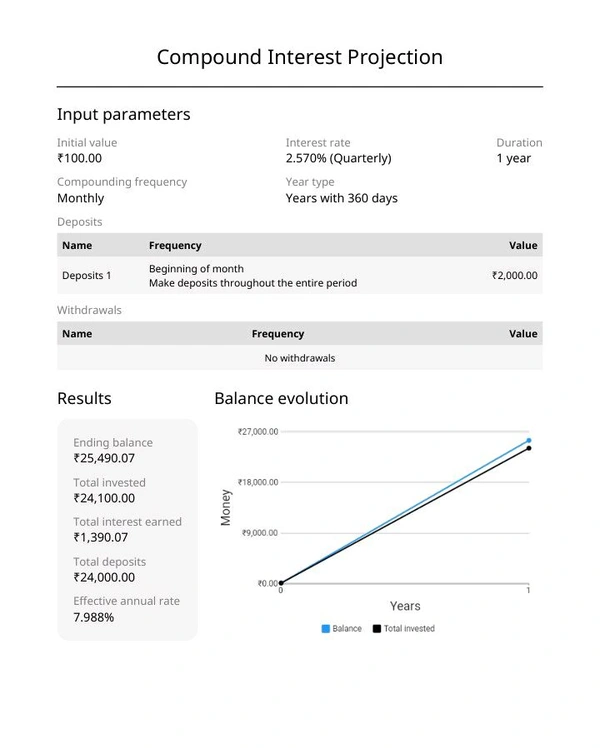

RECURRING DOPOSIT MONTHLY(மாத வைப்புத் தொகை)

Scheme Highlights

Loan Eligibility Criteria Against Recurring Deposit (RD)

Loan Eligibility Based on Maturity Value:

The maturity amount of the Recurring Deposit (RD) — which includes both the principal and interest accrued — will be treated as the base value to assess the loan eligibility.

One RD Equals One Loan Unit:

Each loan offered will be considered against one RD account only, and the maturity value of that RD will represent one loan unit.

Minimum Eligibility Requirement:

To be eligible for a loan, the customer’s RD maturity value must be at least double the loan amount requested.

- Example: If a customer seeks a loan of ₹50,000, their RD maturity amount must be ₹1,00,000 or more.

When Eligibility Criteria is Not Met:

If the RD maturity value is less than twice the desired loan amount, the customer must open an additional Recurring Deposit account(s) such that the combined maturity value of all RD accounts meets the required eligibility.

Combined Deposit Consideration:

The customer may opt for multiple RD accounts, and the aggregate maturity value of these will be considered to calculate the eligible loan amount.

Loan Eligibility Based on Maturity Value:

The maturity amount of the Recurring Deposit (RD) — which includes both the principal and interest accrued — will be treated as the base value to assess the loan eligibility.

One RD Equals One Loan Unit:

Each loan offered will be considered against one RD account only, and the maturity value of that RD will represent one loan unit.

Minimum Eligibility Requirement:

To be eligible for a loan, the customer’s RD maturity value must be at least double the loan amount requested.

- Example: If a customer seeks a loan of ₹50,000, their RD maturity amount must be ₹1,00,000 or more.

When Eligibility Criteria is Not Met:

If the RD maturity value is less than twice the desired loan amount, the customer must open an additional Recurring Deposit account(s) such that the combined maturity value of all RD accounts meets the required eligibility.

Combined Deposit Consideration:

The customer may opt for multiple RD accounts, and the aggregate maturity value of these will be considered to calculate the eligible loan amount.

Reviews and Ratings

No Customer Reviews

Share your thoughts with other customers