RECURRING DOPOSIT - BI MONTHLY(மாதம் இருமுறை வைப்புத் தொகை)

Scheme Highlights

🔹 IMF-SYNERGY: Microfinance Features Overview

1. Loan Categories Offered

Housing Loans – Affordable home loans for low- and middle-income individuals.

Two-Wheeler Loans – Easy financing for purchasing two-wheelers.

Women’s Self-Help Group Loans (SHG Loans) – Group-based loans to empower women entrepreneurs and support rural economic activities.

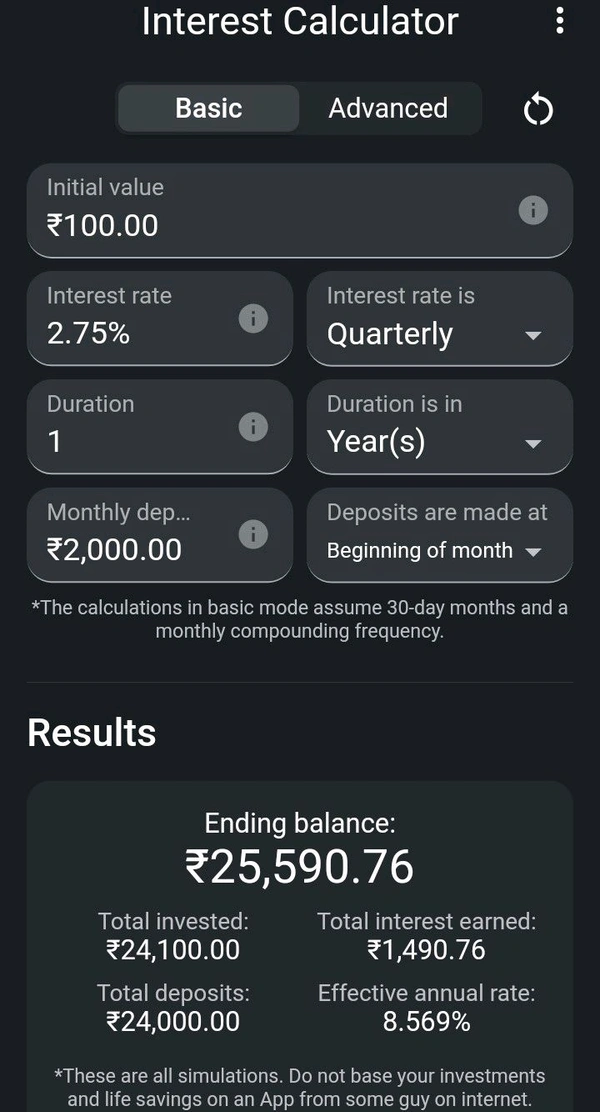

2. Loan Against Recurring Deposits (RD)

Customers can avail loans only after opening a Recurring Deposit account with IMF-SYNERGY.

The loan amount eligibility is linked to the value and tenure of the customer's RD.

RDs act as collateral/security and determine the creditworthiness and maximum loan limit.

3. Interest Adjustment Benefit

Customers earn simple interest on their RD savings.

The interest earned on RD is adjusted to reduce the effective loan interest, offering a net lower interest burden.

Encourages saving while borrowing, fostering financial discipline.

4. Loan Eligibility Criteria

Minimum RD tenure: Typically 6–12 months to become eligible for loans.

Eligibility Amount: A multiple (e.g., 2x to 5x) of the total RD value, depending on loan type and repayment history.

Consistent RD payment boosts eligibility and credit score within the system.

5. Customer-Centric Benefits

Dual Benefit Model: Save through RD while availing credit.

Women Empowerment Focus: SHG loans are designed with flexible repayment and group guarantees.

Reduced Default Risk: The RD base ensures a disciplined approach to both saving and repayment.

Flexible Loan Repayment Options: Based on RD maturity or parallel installments.

6. Key Differentiators of IMF-SYNERGY

Promotes financial inclusion in rural and semi-urban areas.

Focused on low-income and unbanked segments.

Transparent interest policies with no hidden charges.

Encourages micro-savings + micro-lending ecosystem for long-term financial stability.

Loan Eligibility Criteria Against Recurring Deposit (RD)

1. Loan Eligibility Based on Maturity Value:

The maturity amount of the Recurring Deposit (RD) — which includes both the principal and interest accrued — will be treated as the base value to assess the loan eligibility.

2. One RD Equals One Loan Unit:

Each loan offered will be considered against one RD account only, and the maturity value of that RD will represent one loan unit.

3. Minimum Eligibility Requirement:

To be eligible for a loan, the customer’s RD maturity value must be at least double the loan amount requested.

Example: If a customer seeks a loan of ₹50,000, their RD maturity amount must be ₹1,00,000 or more.

4. When Eligibility Criteria is Not Met:

If the RD maturity value is less than twice the desired loan amount, the customer must open an additional Recurring Deposit account(s) such that the combined maturity value of all RD accounts meets the required eligibility.

5. Combined Deposit Consideration:

The customer may opt for multiple RD accounts, and the aggregate maturity value of these will be considered to calculate the eligible loan amount.

Reviews and Ratings

No Customer Reviews

Share your thoughts with other customers